Depreciation expense calculator for rental property

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. First one can choose the straight line method of.

Macrs Depreciation Calculator With Formula Nerd Counter

This is known as the.

. If the home was not available for rent for the full year divide. This depreciation calculator is for calculating the depreciation schedule of an asset. Rental property Architectural digest design Mortgage swaps anworth mortgage Interest rate swaps Deducting depreciation cost recovery Cost recovery.

Lets consider the above example for this cost basis of. 1st year depreciation 12 month 05 12 cost basis recovery period As you can see the only part of this formula that is different from the standard straight-line depreciation method is. This is known as the.

For this year you would depreciate at a rate of 1970 or 5260 1970 percent of 267000. But you can deduct or subtract your rental expensesthe money you spent in your role. This limit is reduced by the amount by which the cost of.

Now lets look at a rental property depreciation recapture example in six steps. Based on this information it. For each subsequent year you would depreciate at a rate of 3636 or 9708.

So for example if you bought a rental property house and lot for 148000 had capitalized purchasing expenses of 2000 and the cost allocated to the land part of the. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. When you rent property to others you must report the rent as income on your taxes. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year.

This rental property calculator allows the user to enter all incomerevenue and expenses as well as information related to the purchase of the property. Purchase a Rental Property Lets assume that Jane purchased a residential income producing. It provides a couple different methods of depreciation.

Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. What is straight-line depreciation example. Using the above example we can determine the basis of the rental by calculating 90 of 110000.

The formula of Depreciation Expense is. So the basis of the property the amount that can be depreciated would be. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Section 179 deduction dollar limits. Straight-line depreciation example Purchase cost of 60000 minus estimated salvage value of 10000 equals Depreciable asset. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property.

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate Depreciation On A Rental Property

Depreciation Formula Calculate Depreciation Expense

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

How To Calculate Depreciation On Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Calculator Most Accurate Forecast

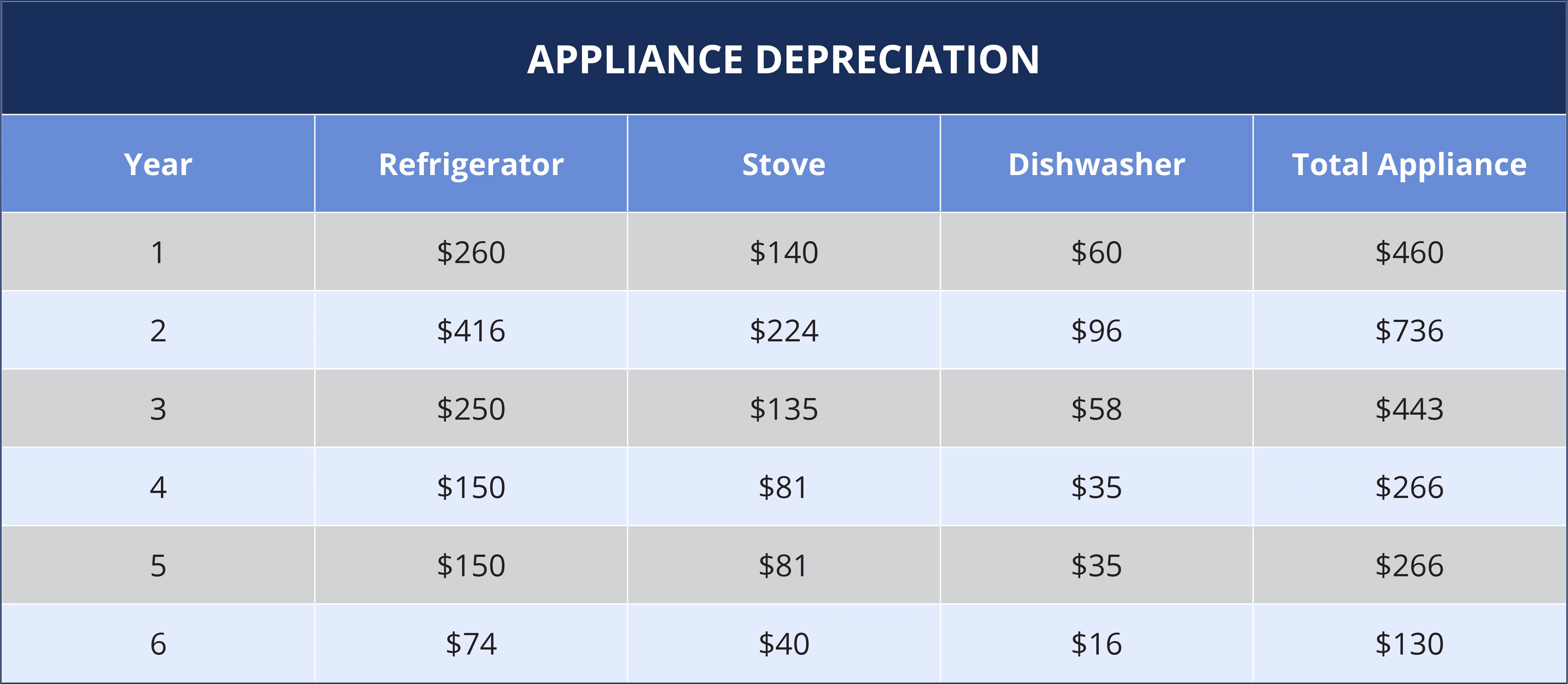

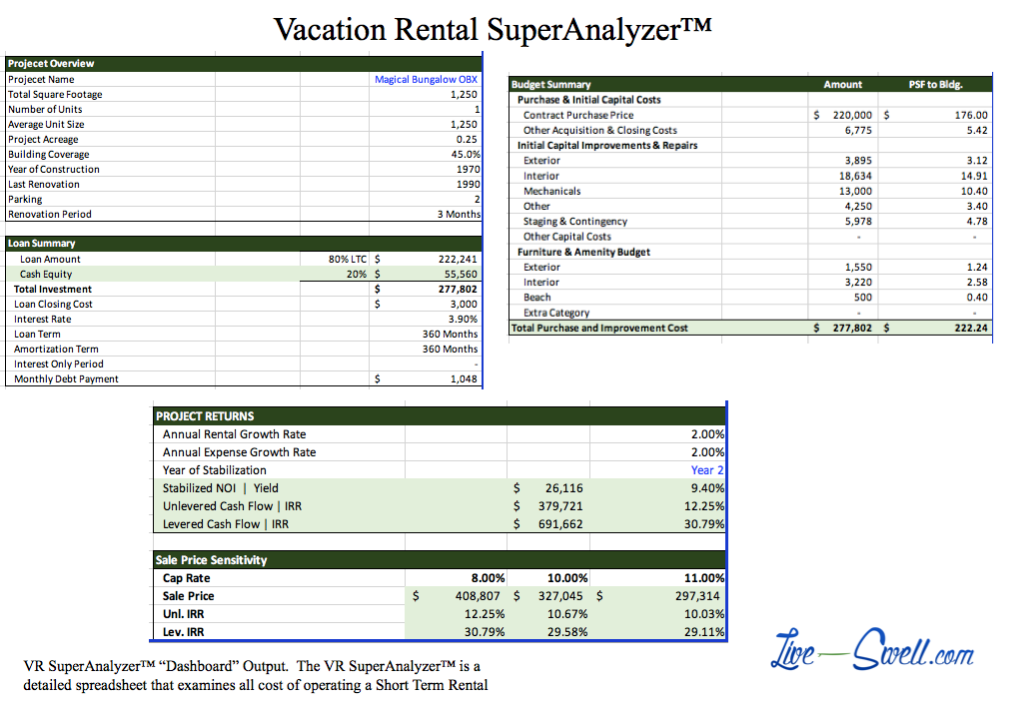

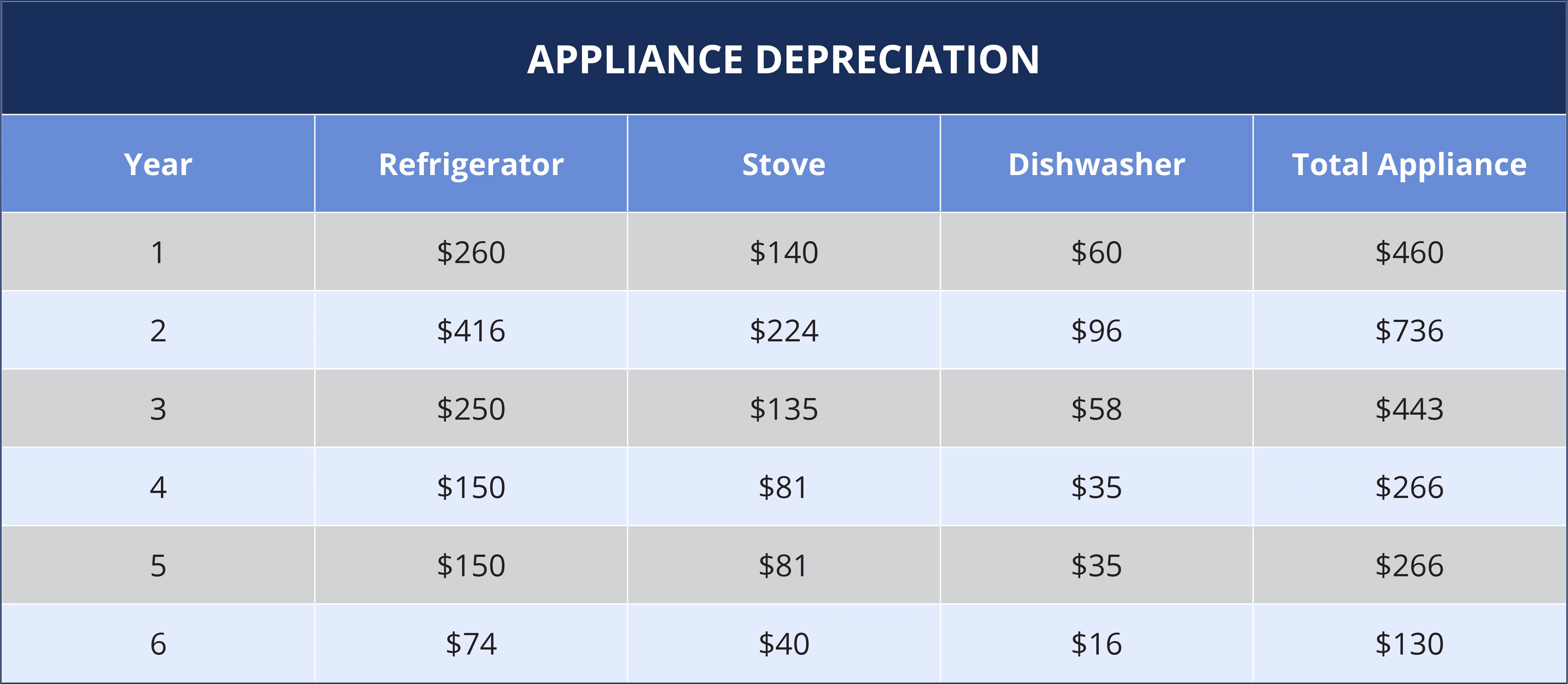

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Calculator United Kingdom Save 36 Countylinewild Com